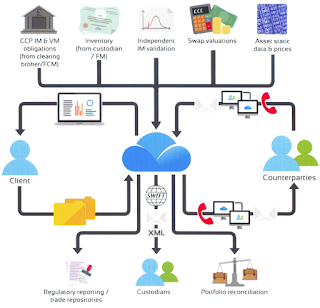

Collateral management systems (CMS) enables you to automate the ordering, communication, and management processes associated with collateral valuation. CMS allows you to access the data stored in your collateral valuation documents, to automate compliance and risk checks, appraisal data validation, and to monitor the performance of your operations.

Collateral management systems are using so as to software applications intended to relieve credit risks general collateralization. They give hazard administration and operations solutions to organizations and foundations of differing sizes. By sending the proper advancements they offer the customer some assistance with addressing both interior and administrative danger administration necessities. They also give organizations the capacity to perceive and oversee presentation while guaranteeing customers get enhanced management. These frameworks accomplish more than go about as tools to give business sector call protection, they likewise provide credit administration arrangements and important data that can serve as notices and break down the risk.

The Collateral management systems can assume an imperative part in helping organizations to control counterparty hazard. Latest experience has demonstrated the need to manage counterparties on a collateralized premise. Older systems expose the financial specialists to pointless danger in today’s unpredictable business sector by utilizing end-of day reporting frameworks.

Compelling new frameworks for managing guarantee to give the ongoing money related data. They likewise alleviate counterparty the hazard by empowering customers to open records and exchange utilizing a scope of money related instruments.

How a Collateral Management System Can Reduce Risk?

Collateral is as much a piece of the advance procedure as money seems to be. It has been utilized for hundreds if not a huge number of years as a method for setting a certification of installment against a credit. In any case, it wasn’t until the 1980’s the point at which the collateral management system appeared. At the time there were no lawful measures for it and most exchanges were ascertained by hand. It wasn’t generally until the full integration of the computer came into business exchange that collateral management turned out to be far reaching and in 1994 the first institutionalization procedures started.

It is the technique used to allow, check and give counsel on a wide range of collateral loans with the motivation behind reducing credit risk for the bank or financial institution.

It is a region in the loan business that has encountered quick development in the most recent decade or two, and has been impacted by new technologies, rivalry and elevated danger taking. It manages the administration of advantage pools, influence, and different features of the financial world making it extremely difficult with a wide range of interrelated capacities, including enterprises, agents, banks and legal groups.

Key Benefits

Ø Easy to use: – Tackle the force of ProtoColl work process to streamline your procedures and diminish operational dangers.

Ø Hosted Solution: – Naturally uproot the requirement for capital expenses on equipment at a passage point with a low starting venture.

Ø Unrivaled Product Support, OTC and beyond: – Sustain for Sec Lending, Repo, FX Forwards, and TBAs.

Ø Fast Implementation

Ø Highly configurable

Key Features

Ø Cash Collateral Management: –

Broad compensation standards and loan fee choices, capitalization and dispersion occasions.

Ø Portfolio Reconciliation: –

Simple to utilize, easy to mix, faster dispute resolution.

4Cpartners is a Financial Markets Consulting organization providing business and technology solutions to clients in the Capital Markets Industry. They do Help banks, fund manager, clearing & settlement houses, and broker to transform their businesses to achieve their goals.

Cover all your business lines on a solitary stage using rules based margining for widest product support.