We have grown reading and listening to the nursery rhyme Humpty Dumpty and what happens to it when it had a great fall. Nobody could put it together. Many India citizens are not untouched with this humpty dumpty syndrome because of the precarious financial situations they are often subjected too. The reasons could be any or many, but there is no denying the fact that in India there is health insurance in India coexisting with Humpty Dumpty Syndrome.

It is common knowledge that health insurance makes people closer to good healthcare by dint of a detailed analysis of the financial requirements during times of medical emergencies. It will help them ward off the Humpty Dumpty Syndrome associated with Health Insurance.

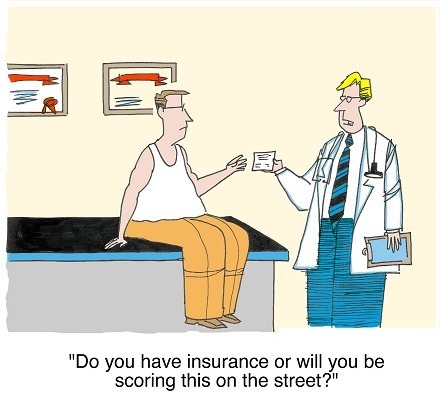

Sitting on the wall: There is an acute absence of government medical programs. Most of the medical expenses are met out of the constricted pockets of the teeming millions. These expenses are incurred through the savings and the hard-earned incomes of individuals. It makes them vulnerable to financial disasters whenever an illness strikes and they find them closer to the Humpty Dumpty Syndrome. Many people do not go out and seek medical assistance and services just because they are not able to afford it.

Medical catastrophe hits without notice. It can hit with vengeance any time and the Humpty Dumpty may fall at any time, any day, any month, any year or for that matter any moment. There are infectious diseases and life threatening diseases like diabetes and cancer. There are cardiovascular diseases that may cause death any moment, and their arrivals are so stealthy that you cannot predict their exact time of strike. India figures towards the top globally across a number of the mentioned diseases above. Many Indians just wait for their fall to be broken into smithereens and never to be put together again likes Humpty Dumpty.

Healthy, wealthy but not wise enough: Despite so much health related problems in India, this area lacks in development or awareness due to the governmental apathy to some extent and also on account of lack of enlightenment on the part of the citizens across the length and breadth of India. There is low literacy, abysmal financial conditions, ignorance of the masses and a host of other reasons that is preventing the maturation of health insurance in our country. There is a general belief in fate and providence. This fatalism also is the reason behind people not accepting the health-related disasters that might strike them any time in future or a resigned attitude that makes them yield to the vagaries of nature. They will not stop blaming it on luck.

There is overdependence on employer’s health coverage. These are the employees who keep demanding better wages, better working conditions, better bargaining position across the table and the health insurance from the employer’s end that takes care of all their health related problems ( if at all they are concerned).

There are a number of problems and reasons that prevent the spread the health-related awareness. It is a herculean task on the part of the policy makers to do away with this all pervasive ignorance at the front of Health Insurance.